The top 5 things to do with your money in your 40s.

The top 5 things to do with money in your 40s.

If your 20s are all about setting good habits for the future and your 30s are about building on those foundations and generating wealth, your 40s are about taking stock of where you are financially and plugging any gaps before retirement. Remember, the magic of compound interest needs decades to work, so the longer you take to create your retirement fund, the less income you will have in retirement.

These are our top 5 recommendations for what to do with your money in your 40s.

1. Calculate your net worth and take stock of your finances.

It’s really important that you get a clear picture of where you stand as nothing brings your life accomplishments into focus like cold, hard figures. Furthermore, it can often be those with the biggest lifestyles that have nothing to show for it when it all boils down. You can read our article about how to calculate your net worth for a full rundown on what to do.

Your net worth is simply everything you own, minus everything you owe. Essentially, if you sold all your assets today and stood by the side of the road, your net worth is everything you would have left. This includes your assets such as pensions, savings, house equity, shares and personal assets of note (like a car or jewellery) and your liabilities like a mortgage, car finance, credit cards and bank loans. If you’ve been a diligent saver and kept debt to a minimum, hopefully, you have accumulated a substantial net worth by the time you are in your 40s. If you haven’t though, don’t panic - there is still time to fix things.

The only slight drawback of knowing your total net worth is that it doesn’t separate the value of your house from your pensions and investments. It’s perfectly possible to have a 100% of your net worth in either category. As a result, it is sensible to separate these categories on paper, so you know what money can be used to produce an income in retirement (pensions, ISA, investments) and what is useful equity that could be liquidated in the future to pay for care (your home).

Our article on how much you need in your pension pots to retire can help you understand your capital needs and once you know your net worth, you can decide if you are on track to meet your goals or not. Typically though, a private pension pot in excess of £500,000 should be sufficient to provide a retirement income in the region of £20,000 without compromising the original capital (although this is not guaranteed).

On the other hand, if you are planning on taking early retirement, our article on the cost of retiring early at 55 may help you understand the financial implications of doing so.

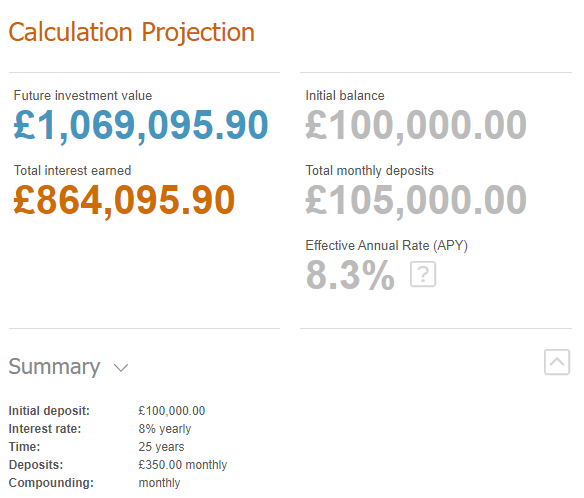

The key takeaway is that you need a target figure in mind and a simple way to check if you will meet that target is to use a compound interest calculator. This looks at your current pension pot, adds your proposed monthly contributions plus interest and forecasts how much your retirement fund will be in the future.

2. Adjust your savings and pension contributions to make sure you hit your targets.

Having calculated your net worth, separated out your pension pots and played around with the different compound interest variables, you will have a much clearer plan of what you need to do to hit your target.

For example, if you are 45 now, have £50,000 in your retirement fund and are able to contribute £150 each month, your pension pot could be worth around £335,000 by the time you are 65, assuming an 8% net annual growth rate (the level of investment returns after all charges have been deducted).

On the other hand, if you are 40 now, have £100,000 in your retirement fund and are able to contribute £350 each month, your pension pot could be worth in excess of £1million by the time you are 65, also assuming an 8% net annual growth rate.

These examples really drive home the importance of the capital you have built to date, the amount you are able to save each month and the length of time your money remains invested.

In order to meet your retirement fund targets, be sure to:

Maximise your employee contributions to your workplace pension.

Consider the employer contributions before taking a new job (anything over 10% is excellent).

Contribute as much as you can each month from your take-home pay to a SIPP/personal pension to take advantage of tax relief.

Consider using your annual ISA entitlement (currently £20,000) as any capital growth or income you benefit from in the future will be tax-free. This is particularly useful if you have maximised all your pension options. Don’t forget that you can hold shares, funds and bonds in an ISA and you can access the money whenever your like - it’s not strictly for retirement.

3. Review your emergency cash reserves.

Everybody needs a cash emergency fund as we all encounter emergencies from time to time, whether they are something minor like the washing machine breaking down or something much more serious. Having a lump sum of easily accessible cash helps to reduce the stress of any situation. We’ve written an article that answers the question of what is an emergency fund and how much do you need so it’s probably worth a read if you haven’t already done so.

Remember though, that an emergency fund really is for emergencies only and it should be replenished as soon as you can if you have to access it. After the last few years, we’ve all seen how quickly the world can turn on its head and everyone’s income has been affected. A cash reserve of between 3 and 6 months of your monthly expenses is a good cushion, however, some may feel that 12 months gives them more comfort. The key to building your retirement fund is to add money to it and leave it there until retirement and cash reserves help you leave your retirement savings alone until you need them.

4. Make sure you have the right level of insurance cover in place.

Depending on your family situation, it’s likely that you could have several financial dependants by the time you reach your 40s. This could mean your spouse/partner, children under 18 and possibly your parents. Imagine what would happen if you were to lose your income, become seriously ill or pass away; how would those that rely on you now survive without you? Additionally, if you are a business owner, have you considered what will happen to your business if you, one of your key employees or fellow shareholders should fall ill or pass away?

If the answer to any of these questions fills you with dread, you are probably under-insured.

If this is the case, it’s worth sitting down with a financial adviser to discuss:

Income protection insurance.

Life insurance.

Critical illness cover.

Key person insurance for businesses.

Business ownership protection.

Be sure to head over to our pages on family protection insurance and business insurance to find out more.

5. Have a conversation about money with your parents.

By the time you are in your 40s, your parents are likely to be in their 60s, 70s or 80s and will have either retired or will be on the verge of retiring. Now is a good time to sit down and have a serious conversation about their finances with them. Perhaps they are concerned about a shortfall in retirement income, maybe they are considering equity release to raise a cash lump sum and what are their plans to transfer the ownership of their assets? It’s also crucial to make sure they have a will in place and they have a power of attorney established with someone they trust. Our article on creating a legacy folder is a great starting point to understanding something everyone needs to have in place for the future.

Conclusion.

Your 40s are a great midpoint to review your financial affairs, set targets and put in place plans to help you have the best retirement possible. It’s also a great time to make sure that your family is protected against all eventualities.

What’s next?

If you need advice on pensions, family insurance, business insurance or how you can invest for the future, you can get in touch with one of our advisors for independent financial advice. We offer a free initial consultation and although we are based in Tunbridge Wells, we advise clients across the UK.

Don’t forget, this article offers information about financial planning and investing and should not be taken as personal advice. Remember that investments and pensions can go up and down in value, so you could get back less than you put in. Tax rules can change and the benefits depend on individual circumstances.