How much should I have in my pension savings pots at 50?

How much should I have in my pension savings pots at 50?

Introduction.

In order to work out how much you should have saved into your pension by the time you are 50, it’s important to first understand what your income requirements in retirement will be and then work out the capital required to generate that income. It is then possible to backdate your target to see where you should be at age 50.

What factors are important to consider when determining how much someone should have in their pension by age 50?

A great first step to determining what your pension savings should be at 50 is finding out how much you have to date. To help put your pension savings targets into context, it is really helpful to consider the following:

Your income: Your current income will play a significant role in determining how much you should aim to have in your pension by age 50. As a general rule of thumb, the more you earn now, the more income you will likely need in retirement.

Your retirement goals: It is important to consider your own personal retirement goals, such as the age at which you want to retire, the lifestyle you would like to have in retirement, and any specific financial goals you would like to achieve (such as paying off a mortgage, travelling and the like). This will help to determine how much you will need to save in order to achieve these goals.

Your expenses: Your current and future expenses should also be taken into account when determining how much you should have in your pension by age 50. This includes both essential expenses (e.g. housing, food, utilities, etc.) and discretionary expenses (e.g. entertainment, travel, etc.).

The performance of your investments: The performance of your pension investments will also be a key factor in determining the size of your pension pot at 50. It is important to consider the level of risk you are comfortable with, as well as the historical performance of your chosen investment vehicles (albeit past performance is not a guide to the future).

Other retirement savings you may have: Finally, it is important to consider any other retirement savings you may have, such as additional pensions, individual savings accounts (ISAs) or any other investments. These can all contribute to the overall size of your retirement savings, provided that is what they are earmarked for!

How much income will I need in retirement?

If you have read our previous article that answers the question of how much do I need in my pension pots to retire, you will know that, according to the Pensions and Lifetime Savings Association (PLSA), the vast majority of single people outside of London will need a pension drawdown income of at least £23,000 each year for a moderately comfortable retirement (£34,000 for couples). This figure rises to £37,000 a year for a comfortable retirement (£54,000 for couples), however, you may have your own goal for an income, which could be £60,000, £80,000, £100,000 or more.

You can check the latest income requirement estimates on the PLSA website.

As you may remember from our article, 4% is typically considered a reasonable rate of withdrawal from a pension pot that balances both the need for income and the preservation of capital (note that the headline gross return of your investments may well be higher, however, we have to take account of inflation and coverage of investment charges/fees). In this case, £23,000 is 4% of £575,000 and therefore this is a good pension pot size to target for many single people. But do bear in mind, that even taking a withdrawal of 4% could result in you running out of money in your lifetime, for example, if investment returns are particularly poor over a long period of time.

The table below illustrates how much income you will need and the capital required to generate that income (a 4% withdrawal rate). These are of course just basic figures that don’t include any allowance for taxation, high levels of inflation etc. However, they do offer a good indication of just how much you need to save for your retirement to ensure that you can balance income with capital preservation (should you wish to be able to fund long-term care for yourself and/or your spouse and pass on your wealth to the next generation). Don’t forget that as a couple, you can split your retirement savings between you and you can also build funds in tax-free ISAs, which will have an impact on your net income and tax bill.

Equally, it’s important to remember that you may have built up an entitlement to a state pension over the course of your career, so you may or may not wish to factor this into your calculations.

|

Income Req |

Pension Pot Req |

|

£23,000 |

£575,000 |

|

£34,000 |

£850,000 |

|

£37,000 |

£925,000 |

|

£54,000 |

£1,350,000 |

|

£60,000 |

£1,500,000 |

|

£80,000 |

£2,000,000 |

|

£100,000 |

£2,500,000 |

How money much do I need in my pension pot to retire?

How can I work out how much money I need in my pension and retirement savings?

With all the above in mind, only you can decide what your target annual income is, whether you are a couple or an individual. As previously mentioned, we use a withdrawal rate of 4% as a very rough guide, so all you need to do is take your desired annual income, divide it by 4 and then multiply that figure by 100 to work out how much money you need in your retirement savings and pension pot.

((Annual Income Target / 4) * 100) = Pension Pot Value Target

Ok, but how much should I have in my pension by age 50?

With the above out of the way, you are probably looking for a more detailed answer, rather than a “how long is a piece of string” approach.

From a financial advice perspective, it is impossible to give an exact amount that someone should have in their pension pots by age 50, as it can vary greatly depending on an individual’s circumstances such as income, lifestyle, retirement goals and attitude towards investment risk.

In our earlier article that explores the question of how much should I have in my pension savings pot at age 40, we suggested that individuals aim to have a pension pot that is the equivalent of around 1.5 times their annual salary by age 40. As such, someone earning £40,000 per year may want to aim for a pension pot of around £60,000 by the time they turn 40. The next step would be to decide how much income they want in retirement and then set aside a monthly savings goal to hit that target – taking full advantage of compound interest.

You may want to look up compound interest and the ‘Rule of 72’ if you are not familiar with how compound interest works. Essentially, a sum of money will double due to interest being paid on interest, over a period of time. The period of time is roughly determined when the number 72 is divided by the interest rate. For example, if you could get an interest rate of 8%, your money would double in 9 years (72/8). If the interest rate was 5%, your money would double in 14.4 years and so on.

The main questions at age 50 are how long you want to continue working until you retire and what interest rate can you achieve on your investments?

The table below shows roughly what your retirement savings could be worth in 9 years, if you were able to achieve an interest rate of 8%. Again, these are just rough figures and don’t take into account inflation etc. If you are 50 now, these figures would take you up to 59, at which point you may be thinking about taking early retirement or you may have up to another decade in work, it all depends on your financial needs, current position and retirement income goals.

|

Savings at 50 |

Int. Rate |

Yrs. to 2x |

Future value |

|

£30,000 |

8% |

9 |

£60,000 |

|

£50,000 |

8% |

9 |

£100,000 |

|

£75,000 |

8% |

9 |

£150,000 |

|

£125,000 |

8% |

9 |

£250,000 |

|

£200,000 |

8% |

9 |

£400,000 |

|

£300,000 |

8% |

9 |

£600,000 |

|

£500,000 |

8% |

9 |

£1,000,000 |

How much will my pensions be worth in 9 years at 8% interest, compounded?

If you don’t think that these figures are likely to provide the level of income you need when you retire, the earlier you can take action, the better off you will be.

Your main consideration at age 50 should be how much you can save each month into your retirement savings pot to bolster it and hit your savings goal. This can be via your employee pension contributions with added tax relief, extra employer contributions, your own personal SIPP contributions (again with the possibility of tax relief) and ISA savings that use taxed money now to provide tax-free savings and investment returns in the future. So let’s look at this in more detail.

How much do I need to invest into my pension each month to retire?

As explained above, this should be the crux of any pension review you are undertaking at age 50. If you know how much you already have and how much you are going to need in retirement, the final piece of the puzzle is to establish a pension savings plan to meet your target.

To give yourself a quick estimate of how much you need to save each month, you can use a simple online compound interest calculator. The variables you need to consider are how much you already have, how many years you want to continue working, how much you can save each month, what the investment returns are (7% is a reasonable place to start) and, of course, what your target is.

As an example, if you:

Are aged 50.

Have approximately £125,000 already saved into your retirement and pension savings pots.

Want to retire at 67 (so have 17 years left to save).

Need an income in retirement of £54,000 (so, your pension pot saving target should be in the region of £1,350,000).

Expect an investment return of 7%.

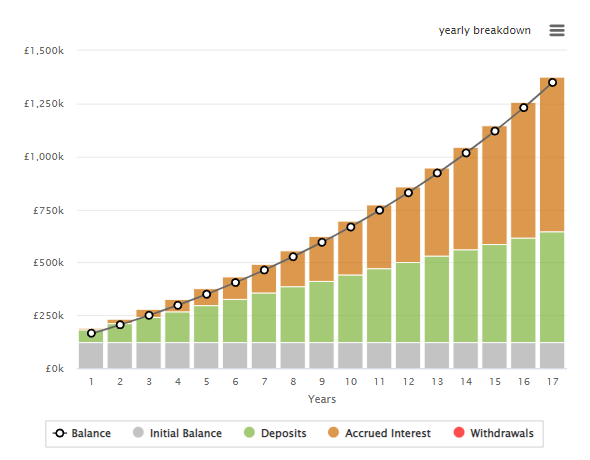

You will need to invest something in the region of £2,410 every month until retirement. This is of course only a very basic calculation as you will also need to consider inflation, investment charges, platform charges and much more.

A basic pensions savings target illustration. £125k to £1.35m over 17 years, £2,410 PCM at 7% compounded.

If you want to get more detailed, you can use our UK Pension Pot Calculator. Again, it’s important to stress that a financial adviser would work closely with you to assess these factors and develop a pension savings target and a comprehensive plan that takes into account your unique circumstances and goals. This plan would be regularly reviewed and adjusted as needed to help you stay on track to meet your retirement goals.

Conclusion.

What clients often find staggering is just how much money is required to enjoy a comfortable retirement. It is also important to remember that compound interest works like magic, so if you can front-load the amount you save for the next decade, the investment gains could be significantly higher in the long run than if you make large contributions just before you retire.

Overall, the guidance is to save as much as you can, save regularly, save as early as possible, set an ambitious target and work with a financial adviser to regularly review your position. You can even arrange a free initial consultation with one of our highly qualified and experienced advisers to discuss ways you can maximise your retirement savings and income in retirement.

What’s next?

If you want to bring yourself up to speed on the topic of pensions, a great place to start is this index of pension articles we’ve published on the subject. If you need help or advice on your personal or business finances or if you want to consider investing to make your money work harder, you can get in touch with one of our advisors for independent financial advice. We offer a free initial consultation and although we are based in Tunbridge Wells, we advise clients across the UK.

Don’t forget, this article offers general financial information and should not be taken as personal advice. Remember that investments and pensions can go up and down in value, so you could get back less than you put in. Tax rules can change and the benefits depend on individual circumstances.