House prices vs income. How affordable are UK homes?

House prices vs income. How affordable are UK homes?

Introduction.

If you, friends or family have tried to buy a house recently, you will be well aware of just how high house prices in the UK have risen. The question is though, are houses getting more or less affordable in the UK when compared to salaries? Also, how much would a house cost today if property prices increased at the same rate as salaries?

The history of house prices in the UK over the past 40 years.

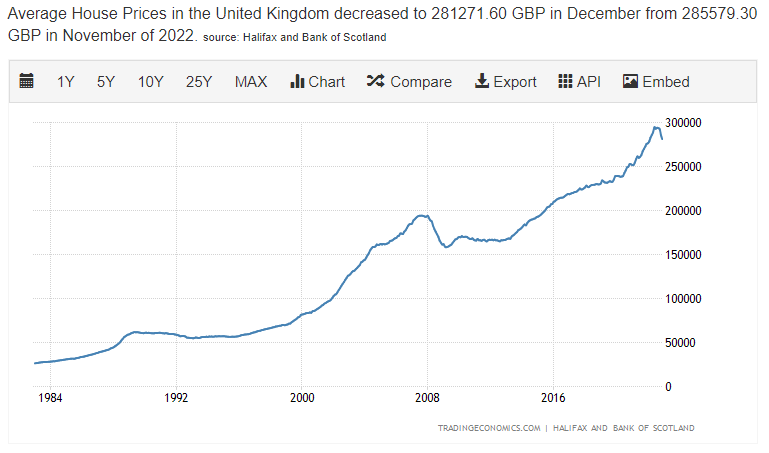

If we go back in time 40 years to 1983, the average house price in the UK was around £26,000. Ten years later, the average house price in 1993 had risen by 115% to around £56,000. Looking forward another decade to 2003 and the average house price was now up 123% to £125,000. Stepping forward again to 2013, following the Global Financial Crisis, the average house price had increased by just 32% to £165,000. Finally, looking back over the last decade, the average house price is now around £280,000 – an increase of 70% on prices just 10 years ago.

Average house prices in the UK 1983 to 2023.

Looking at this 40-year period as a whole, we started with the average house price sitting at £26,000 and we are left with an average house price today of £280,000 (an increase of 976%). Interestingly, if we use the Bank of England’s inflation calculator, goods and services that cost £26,000 in 1983 now cost £81,000 in November 2022 (the equivalent of a 211% increase). This means that the price of the average house in the UK has risen 4.6 times more than CPI inflation. As a result, it’s no wonder house prices are often the hot topic of conversation and long-term affordability is being called into question.

To summarise each 10-year period:

In 1983 the average house price in the UK was £26,000.

In 1993 the average house price in the UK had risen 115% to £56,000.

In 2003 the average house price in the UK had risen 123% to £125,000.

In 2013 the average house price in the UK had risen 32% to £165,000.

In 2023 the average house price in the UK had risen 70% to £280,000.

The history of average salaries in the UK over the past 40 years.

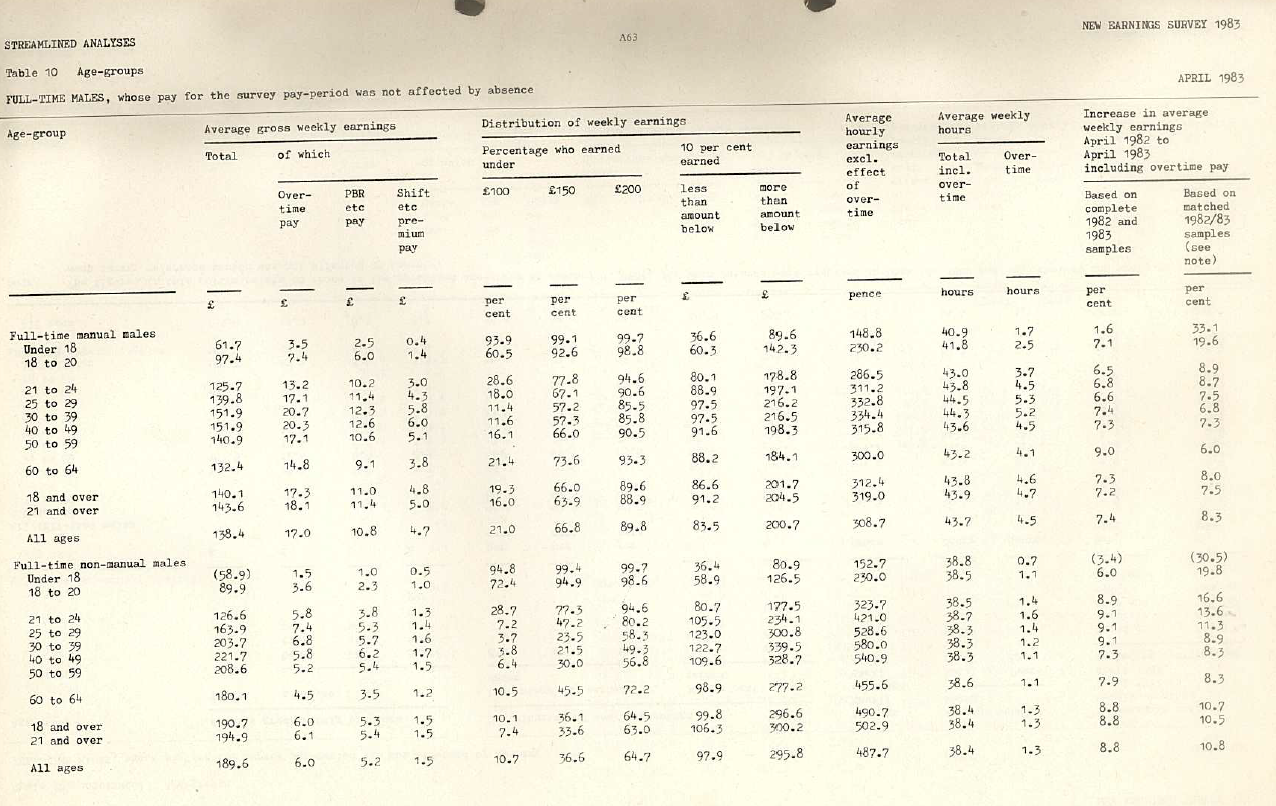

Getting hold of reliable data on UK average salaries from 1983 is a little bit difficult, however, we can see from old ONS data that the average weekly earnings for men were £164; the equivalent of £8,528 each year. By the time 1993 comes around, this average figure had risen to £342 per week or £17,784 each year.

Average salaries in the UK 1983

Data starts to be recorded digitally towards the end of the 1990s and we can revert to Statista for the average salary data, which was £21,124 in 2003. This figure rose again to £27,011 in 2013 and finally to £33,000 at the end of 2022.

To summarise each 10-year period:

In 1983 the average salary in the UK was £8,528.

In 1993 the average salary in the UK had risen 108% to £17,784.

In 2003 the average salary in the UK had risen 19% to £21,124.

In 2013 the average salary in the UK had risen 28% to £27,011.

In 2023 the average salary in the UK had risen 22% to £33,000.

Just a quick glance at these average salary figures shows that there was significant growth in the decade up to 1993 before wages stagnate for the next 30 years. In fact, at no point in each of these data steps have salaries increased faster than house prices.

The history of house price affordability UK over the past 40 years.

House price affordability is simply the number of times the average salary needs to be multiplied to buy the average house. For example, in 1983 the average house price was £26,000 and the average salary was £8,528. Therefore, it would take 3 times the average salary to buy the average house.

In 1993 the average house price was £56,000 and the average salary was £17,784. Therefore, it would take also 3.1 times the average salary to buy the average house.

In 2003 things got more expensive as the average house price was £125,000 and the average salary was £21,124. Therefore, it would now take 5.9 times the average salary to buy the average house.

In 2013, affordability took another hit as the average house price was now £165,000 but the average salary was only £27,011. Therefore, it would take 6.1 times the average salary to buy the average house.

In 2023 (figures from 2022), house affordability took another turn for the worse as the average house price rose to £280,000 and the average salary had only risen to £33,000. Therefore, it would take 8.5 times the average salary to buy the average house.

What would UK house prices be if they rose in line with average salaries?

Essentially, house prices tracked salaries for the most part from 1983 to 1993, however, it was only in the decade between 1993 and 2003 that house prices really jumped in the UK. Looking at the figures, house prices should only have grown from £56,000 to £66,000 between 1993 and 2003, not to £125,000 if they were to keep pace with salaries.

Remarkably, the Global Financial Crisis managed to keep a lid on property price growth in the period 2003 to 2013 where again, average house prices broadly tracked average salaries. However, it’s the most recent decade where prices have accelerated beyond salaries at an increased rate. Indeed, the average house price in the UK should be around £201,000, not £280,000 if property prices more accurately reflected salary growth.

Conclusion.

It’s clear that from these figures, house prices can only increase when it’s affordable for people to buy them. How much further can affordability be stretched? Will it rise to 10x average salaries? Furthermore, what caused the increase in average house prices?

Was this due to the growth of the buy-to-let industry? Was everyone sitting at home watching homes under the hammer thinking that they were missing out? Was it due to a large growth in the population or an increase in the divorce rate and the rise of single-parent homes? Could it have been a result of historically low interest rates? It’s impossible to pinpoint one single driver for growth as it’s very likely to be a combination of all these factors.

What do you think has caused the huge increase in property prices? Why do you think average salaries have grown so little over the last few decades? Let us know in the comments below.

What’s next?

If you need help or advice on your mortgage, personal or business finances or if you want to consider investing to make your money work harder, you can get in touch with one of our advisors for independent financial advice. We offer a free initial consultation and although we are based in Tunbridge Wells, we advise clients across the UK.

Don’t forget, this article offers information about mortgages and property and should not be taken as personal advice. Think carefully before securing debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage or any other debt secured on it. This article also offers information about investing and should not be taken as personal advice. Remember that investments and pensions can go up and down in value, so you could get back less than you put in. Tax rules can change and the benefits depend on individual circumstances.