The proposed changes to Capital Gains Tax (CGT) explained.

Capital Gains Tax (CGT) is, very broadly, a tax on the difference between an asset’s value when acquired and its value at disposal, less any allowable expenses. The main exemption is a relief for a taxpayer’s main or only home. Assets can be acquired in various ways including through purchase, inheritance or as a gift, and are generally disposed of either through selling or gifting.

Broadly, those paying CGT are business owners (for example, holding shares in an unquoted trading company), investors (for example, holding a buy-to-let property, a second home or a portfolio of listed shares outside a pension or ISA) and employees (for example, who participate in share schemes).

Who pays Capital Gains?

In the 2017-18 tax year £8.3 billion of CGT was paid and £55.4 billion of net gains (after deduction of reported capital losses) reported by a total of 265,000 individual UK taxpayers. This compares with the £180 billion of Income Tax paid in 2017-18 by 31.2 million individual taxpayers.

Most people do not need to pay CGT very often, but those who do often pay large amounts: Income Tax raises over 20 times as much overall, but the average amount of CGT paid by those who are liable to the tax is £32,000, which is more than five times the equivalent figure for Income Tax.

Rates of CGT

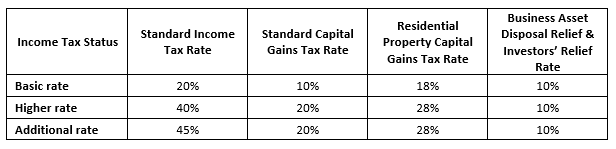

There are four different rates of CGT all of which are lower than the equivalent standard rates of Income Tax. The rates depend on the Income Tax status of the taxpayer and the type of asset disposed of, as shown below.

Shake up of CGT

CGT is a potential target for reform to start to recoup the significant costs of the pandemic. The recommendations put forward by the Office of Tax Simplification (OTS) in its review of CGT, which were published on 11th November, have created quite a stir.

If the key proposals for CGT are adopted, current CGT planning opportunities may be lost, particularly for owner managed businesses.

Within their report, the OTS deals with recommendations by reference to four areas where there are policy choices for governments to make. In each of these areas their report sets out interlinked changes which would need to be considered in the round.

1. Rates and boundaries

Recommendation: More closely align CGT rates with Income Tax rates or consider addressing boundary issues between CGT and Income Tax.

Rationale: The current rates of CGT are lower than standard Income Tax rates. This disparity is one of the main sources of complexity. It can also distort business and family decision-making and it creates an incentive for taxpayers to arrange their affairs in ways that effectively re-characterise income as capital gains. Most gains are concentrated among relatively few taxpayers, who also tend to have more flexibility about when they dispose of their assets. This can mean that they pay proportionately less tax on their overall income and gains than others. A greater alignment of rates would reduce the need for complex rules to police the boundary between income and gains, as the way income is classified would not affect the tax position. More closely aligning CGT with Income Tax rates has the potential to raise a substantial amount of tax for the Exchequer - as much as £14 billion a year. This is clearly a huge amount of money, but to give this some context, here is what the three biggest taxes raise each year for the UK:

Income Tax - £195 billion

National Insurance Contributions - £144 billion

VAT - £133 billion

However, the OTS acknowledges there would be significant behavioural effects, which would materially reduce this, including an impact on people’s willingness to dispose of assets and trigger a tax charge, increasing the extent to which CGT has a ‘lock in’ effect.

2. The Annual Exempt Amount

Recommendation: Reduce the Annual Exempt Amount (potentially to somewhere between £2,000 and £4,000). The Annual Exempt Amount (currently £12,300 in the tax year 2020-21) is a threshold below which an individual’s overall gains chargeable to CGT in a given tax year are not taxed.

Rationale: The Annual Exempt Amount could be considered to fulfil one or more purposes:

An administrative de minimis, to reduce the number of people who need to submit CGT information – however, it’s believed to be too high to serve only as an administrative de minimis and that it is in effect more like a relief.

A broader more substantive relief, comparable to the Income Tax personal allowance – the personal allowance for income tax is currently £12,500 in the tax year 2020-21.

A rough and ready way to compensate for inflation - the OTS considers this is an ineffective way to achieve this objective, as it does not consider holding periods or asset values.

The OTS surmises that the relatively high level of the Annual Exempt Amount distorts investment decisions. In tax year 2017-18, around 50,000 people reported net gains close to the threshold and so ‘use up’ the allowance which is straightforward for holders of listed share portfolios. However, in making their recommendation, the OTS is very mindful of the administrative implications of a lower Annual Exempt Amount and the consequences of bringing more people into the tax system. If taxpayer behaviour did not change, the number of taxpayers required to pay CGT in 2021-22 would double if the Annual Exempt Amount were reduced to around £5,000 and would nearly triple at an Annual Exempt Amount level of around £1,000.

3. Capital transfers

Recommendation: Where a relief or exemption from Inheritance Tax (IHT) applies, remove the capital gains uplift on death, and instead provide that the recipient is treated as acquiring the assets at the historic base cost of the person who has died. In addition, remove the capital gains uplift on death more widely, and instead provide that the person inheriting the asset is treated as acquiring the assets at the historic base cost of the person who has died.

Rationale: The OTS considers that at present the way CGT and IHT interact is incoherent and distortionary. Comparable transactions can lead to situations where either one, both or neither of the taxes arise. This reflects the combined effects of IHT exemptions and reliefs (for businesses, farming businesses, and assets passing to a surviving spouse) and the CGT exemption on death, coupled with the fact that those inheriting assets do so at their market value for the purposes of calculating any gain on a subsequent sale (known as the ‘death uplift’). These features of the present rules incentivise decisions about the times assets are transferred which may not be best for the business, the individuals or families involved, or for the wider economy.

4. Business reliefs

Recommendation: Replace Business Asset Disposal Relief with a relief more focused on retirement; and abolish Investors’ Relief.

Rationale: Investors’ Relief and Business Asset Disposal Relief (formerly Entrepreneurs’ Relief) are two of the main reliefs which are intended to encourage investment. Both reliefs reduce the CGT payable on the disposal of qualifying business assets, by applying a special tax rate of 10%. Business Asset Disposal Relief is targeted at owner managers and certain employee shareholders while Investors’ Relief is targeted at external investors. Business Asset Disposal Relief and its predecessors have also long been understood as having another objective – as a specific relief when business owners retire. This was originally in recognition that a person’s business can be an alternative to a pension, representing many years of constant re-investment. The OTS recognises that Investors’ Relief is a new relief, which investors have been able to claim only in relation to investments made from April 2016 and disposed of from April 2019. As a result, evidence about the extent to which relief has been claimed against disposals is necessarily limited, however, based on anecdotal evidence almost no-one has shown any interest in this relief or is using it.

Summary

It's important to remember that none, or only some, of these changes may come into play and there is of course the question of when changes could happen. The key step for individuals and businesses that may be impacted is that they speak with their advisers – whether that’s a legal adviser and/or tax or financial adviser - to discuss what action, if any, needs to be considered. If you’d like to speak with one of our Financial Advisers about any of the issues discussed here, please contact us and we will be happy to have an initial discussion at our cost.

Please note: Tax rules can change and the benefits depend on individual circumstances. This article offers information about financial planning and should not be taken as personal advice.